Tokenised markets: balancing blockchain benefits with regulation

Bringing the blockchain together with the highly regulated financial industry is challenging but offers huge potential. But how might it be done?

Blockchain’s appeal – its decentralised nature, which makes it more transparent and efficient – is the exact same thing that makes it so hard for banks to start using it. At odds with the way banks operate, the blockchain complicates law enforcement and make it harder for banks to comply with the regulatory controls to which they are subject. And yet: its potential is huge.

A blockchain is a forgery-proof database whose control and decision-making are distributed across a network rather than being held by a central authority. It is this decentralised nature that makes it difficult for financial institutions to ensure transactions are compliant with Know-Your-Customer (KYC), Anti-Money Laundering (AML), Countering the Financing of Terrorism (CFT) and sanctions requirements. However, blockchain also offers many advantages, including enhanced transparency, reduced intermediation costs and increased security. Every transaction is recorded across a shared, synchronised ledger that is visible to all authorised participants, making it nearly impossible to alter records without detection.

It is essential that all relevant stakeholders collaborate so that the financial industry, clients, and fintechs can collectively benefit from blockchain technology to foster new growth with enhanced resilience and inclusiveness.

Participants can monitor asset flow and verify transactions independently. This builds trust, reduces the risk of fraud and enhances accountability in financial systems.

While these benefits can lead to more efficient and inclusive financial systems, foster innovation and democratise access to financial services, additional measures must be put in place to preserve the confidentiality of transaction details on the blockchain.

Blockchain meets regulated finance: forging a more robust financial future

What if blockchain’s strengths could meet the demands of regulated finance? A recent Deutsche Bank and Nethermind white paper "From Wallet to Chain: A Bridge of Two Worlds on an Ethereum Transaction" suggests this fusion could build a more efficient, transparent and trustworthy financial system by aligning blockchain’s tech with regulatory goals. Nethermind is a blockchain research and engineering firm known for its work on Ethereum infrastructure and tooling.

Looking at the entire transaction on the Ethereum blockchain – from initial user submission in the wallet to confirmation to finality (the point at which a blockchain transaction cannot be changed or reversed) – the white paper describes how emerging public blockchain attributes can meet compliance, governance and resilience standards of regulated financial markets.

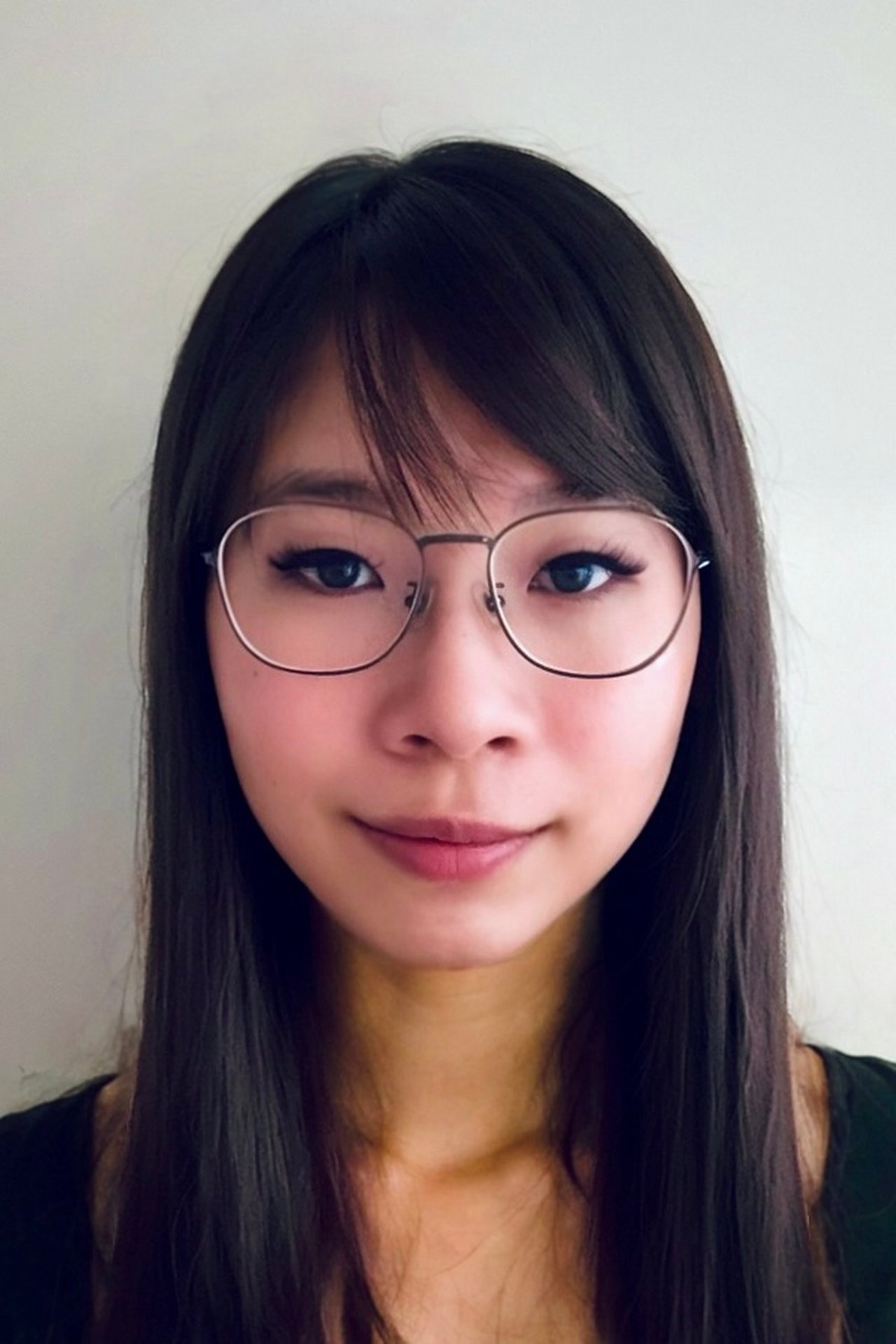

“The real breakthrough isn’t just in the code – it’s in designing systems where transparency and compliance aren’t trade-offs, but co-drivers of trust. Transparency involves demonstrating the execution and legitimacy of transactions without disclosing full details beyond those who need to know.” says Deutsche Bank’s Jaelynn Lee, co-author of the white paper and Digital Product Owner with Deutsche Bank’s Corporate Bank.

How it works

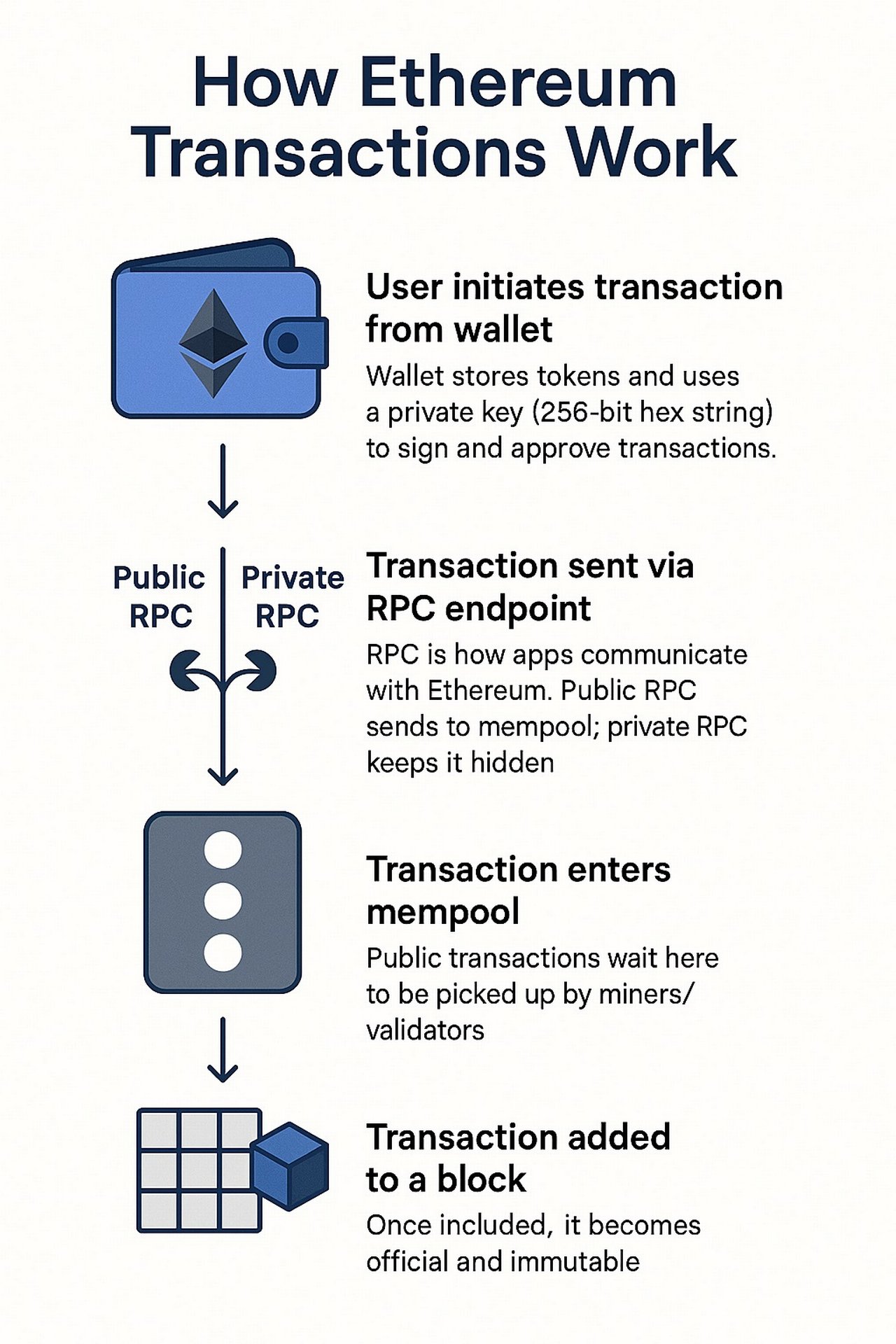

Ethereum blockchain transactions start in a user’s wallet – a digital tool that lets the user store, send and receive tokens. The user signs and approves transactions using a private key – a secret 256-bit number usually represented as a long, hexadecimal string – to prove ownership of an account.

The transaction goes to the network through either a public (default) or private Remote Procedure Call (RPC) endpoint, a gateway the user’s app uses to talk to, in this example, Ethereum. The RPC – how one computer or programme asks another to retrieve data or send a transaction – can either send a transaction to the public mempool, making it visible to everyone, or through a private channel, keeping it hidden from the public mempool.

A mempool is the waiting area for transactions received by the network, where they await inclusion in a block and are permanently recorded on the blockchain, making it official and immutable.

Addressing regulatory concerns on public blockchain

There are, however, a number of factors that complicate the usage of public blockchain for banks. This includess how transactions are selected or prioritised for inclusion, and how fees and value are earned by intermediaries like block builders and block proposers (validators) during this process.

On public blockchains like Ethereum, users compete for faster inclusion in blocks by setting priority fees in addition to the base gas fees required. This creates a market to process transactions efficiently under limited block space. Validators, or block builders, have the freedom to decide the inclusion and sequence of transactions in a block. And so, by strategically reordering, including, or excluding transactions in a block, validators seek to extract the maximum value within a block during its creation – a practice known as Maximal Extractable Value (MEV).

This flexibility opens the door to abuse, though, for example by way of frontrunning (inserting a transaction ahead of a large pending order to benefit from the market impact) or sandwiching (placing one transaction before and one after a target transaction to exploit price movements).

The authors of the white paper propose various countermeasures against MEV abuse and transaction privacy.

- Encrypted mempools: hide key details – like sender, recipient, and value - until the transaction is confirmed in a block.

- Private order flows: offer MEV protection and transaction privacy while enabling compliance controls, making them ideal for regulated finance. Transactions are routed via private RPCs to whitelisted, trusted block builders, bypassing the public mempool and limiting exposure to untrusted actors. These builders can be required to follow rules such as fair transaction inclusion and sanctions screening.

When implemented alongside emerging protocols like Proposer-Builder Separation (PBS) on Ethereum, these innovations may help achieve accountability and neutrality outcomes, as well as ensure fair transaction processing and privacy on public blockchains.

PBS decouples block building from block proposal by outsourcing the former to specialised third-party builders. Traditionally, validators handle both block building (selectively ordering and including transactions to maximise gas fee rewards) and validating (proposing the validated block for inclusion in the chain). However, block building has evolved into a highly specialised task requiring sophisticated tools to optimise block value/reward, increasing barriers to entry for validators. In models like MEV-Boost, validators (as block proposers) select blocks built externally and do not influence the transaction sequence within them. This role specialisation mirrors the segregation of duties in the traditional world, where no single person or entity controls both the “making” and “checking” of transactions.

Together, these innovations bring public blockchain infrastructure closer to the execution standards and control once thought possible only on private chains.

Finality and trust: beyond the blockchain code

Another critical factor for institutional adoption of blockchain technology is transaction finality. This refers to the point at which a blockchain transaction is permanently confirmed and cannot be changed or reversed; users know that it is settled for good.

Combining blockchain's transparency, security and efficiency with the oversight of the traditional financial industry can reduce inefficiencies. But infrastructure breakthrough alone isn’t enough.

Ethereum, for example, uses a mechanism called proof-of-stake (PoS) consensus to make transaction reversal economically and operationally infeasible. PoS involves validators locking large amounts of Ether, the native cryptocurrency of the Ethereum blockchain, as collateral. If they try to manipulate or reverse transactions, they risk losing this stake. This high financial penalty is what secures the network’s finality.

"Combining blockchain's transparency, security and efficiency with the oversight of the traditional financial industry can reduce inefficiencies, " says Lee. “But infrastructure breakthrough alone isn’t enough. Whether tokenisation scales or stalls also depends on how regulations, secondary market liquidity and market requirements are met.”

Therefore, the success of tokenised markets will depend on more than just technical solutions.

In collaboration with global law firm, Baker McKenzie, Deutsche Bank explores the broader forces shaping adoption in a joint white paper “Tokenisation of Financial Markets: Mapping the Plausible Future Through Scenario Analysis.”

Developing functional and liquid tokenised markets requires collaboration between banks, fintechs and regulators. Banks can provide financial infrastructure, liquidity and compliance know-how. Fintechs can drive innovation in asset tokenisation and operate digital exchanges. And regulators can establish harmonised compliance frameworks and provide legal certainty for assets on a blockchain.

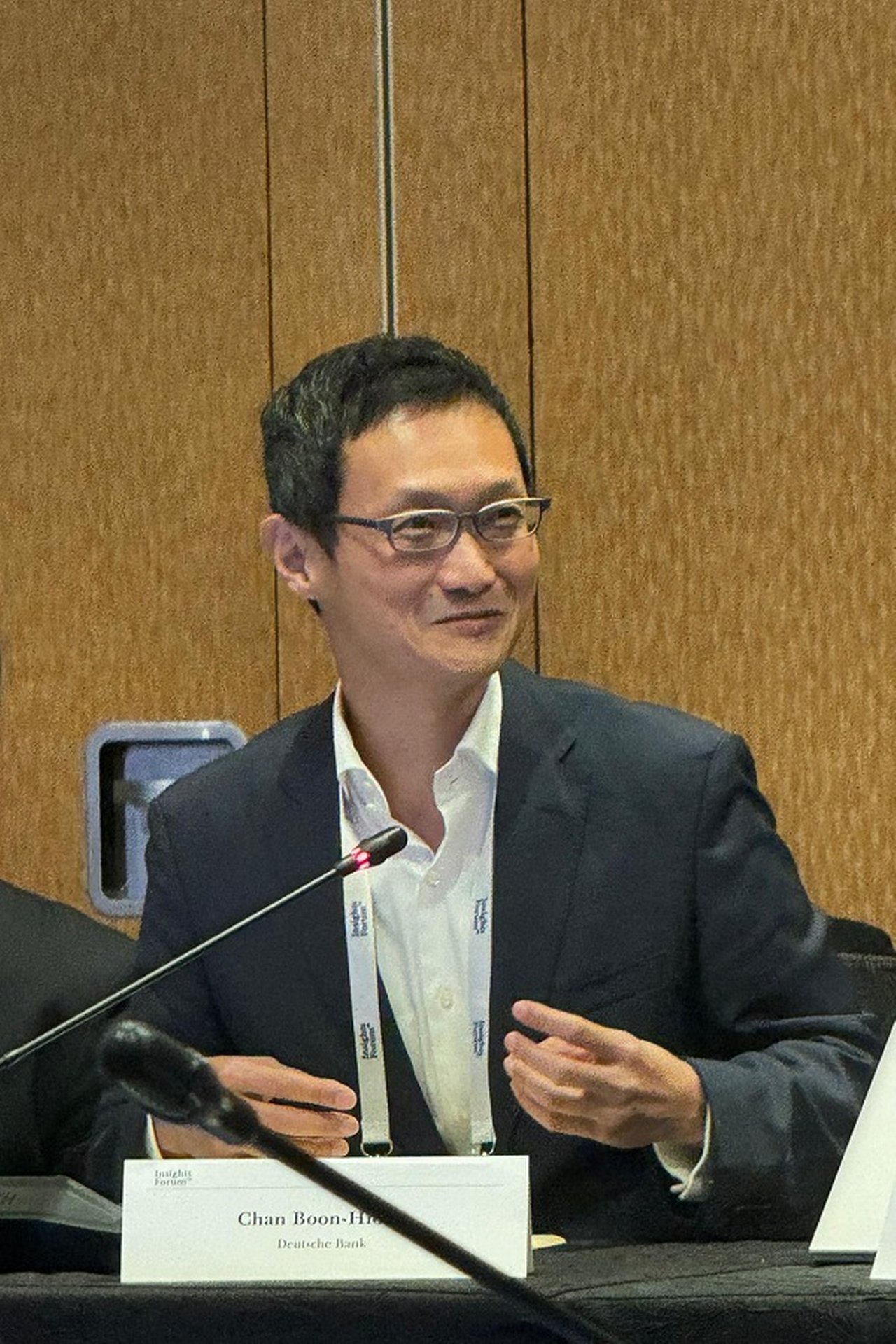

Boon-Hiong Chan, Head of Securities Market and Technology Advocacy at Deutsche Bank believes that tokenisation will scale when innovation is matched by regulatory clarity and market demand. ”It is essential that all relevant stakeholders collaborate so that the financial industry, clients, and fintechs can collectively benefit from blockchain technology to foster new growth with enhanced resilience and inclusiveness. Scaling should be facilitated by cost-effectiveness, clarity, and ease of adoption without technical complexities.“

This page was published in August 2025

Jaelynn Lee and Boon-Hiong Chan are co-authors of the reports mentioned in this article.

About Jaelynn Lee

Jie Yi (Jaelynn) is an early financial professional specialising in securities servicing and digital solutions, particularly in the applications of distributed ledger technology and artificial intelligence. In her current role, she is responsible for a portfolio of digital products, managing their functionalities, go-to-market execution globally, cross-team collaboration, and regulatory governance.

Diving deeper into the intersection of technology and finance with an interest to innovate and streamline processes, Jaelynn is also a core member of the Deutsche Bank team in Monetary Authority of Singapore's Project Guardian.

About Boon-Hiong Chan

Boon-Hiong Chan is a product builder, regulatory advocator, and innovator with about 25 years of experience in banking and capital markets. He specialises in the intersection of regulations, technology, and financial services to facilitate foresight, business strategic positioning, and transformation of competitiveness. His track record includes analysis and advocacy of complex capital markets and technology regulations, applications of blockchain/DLT and artificial intelligence, fintech collaborations, resource and client management, leading teams through changes, go-to-market, and thought leadership.

Boon is a community volunteer and a proponent of aged economics and financial inclusion. An active participant in industry associations, a board of directors, and innovation panels evaluator, he holds accountancy, private equity/venture capital qualifications, and graduated with MSc Computation/AI and MEng Cybersecurity and Policy.

Harikumar Rajasekhar

… leads digital communications and social media strategy for Deutsche Bank across Asia-Pacific, the Middle East, and Africa – crafting impactful messaging in a complex, fast-paced landscape. Off the clock, he’s a passionate technologist, fascinated by the evolving relationship between humans and machines, and always exploring how emerging tech can reshape the way we connect, work, and think.

Recommended content

Digital Disruption | Opinion

“We need a DLT highway for the capital market” “We need a DLT highway for the capital market”

Why KfW relies on digital bonds and calls for a modernised infrastructure for the competitiveness of the European capital market. A conversation with KfW Group Treasurer Tim Armbruster.

Digital Disruption | Outlook

Invest faster and broader thanks to blockchain Invest faster and broader thanks to blockchain

Stock market and blockchain expert Lidia Kurt on the transformative power of blockchain technology in securities trading and the “Internet of Value”.

Digital Disruption | Opinion

“In the tokenised economy we can make money smart” “In the tokenised economy we can make money smart”

Investing in luxury hotels or a Picasso painting? Deutsche Bank expert Sabih Behzad explains how a tokenized economy will revolutionize investments and payment flows. And where the risks are lurking.