Global Hausbank

First choice in all financial matters

Strategy

What Deutsche Bank stands for

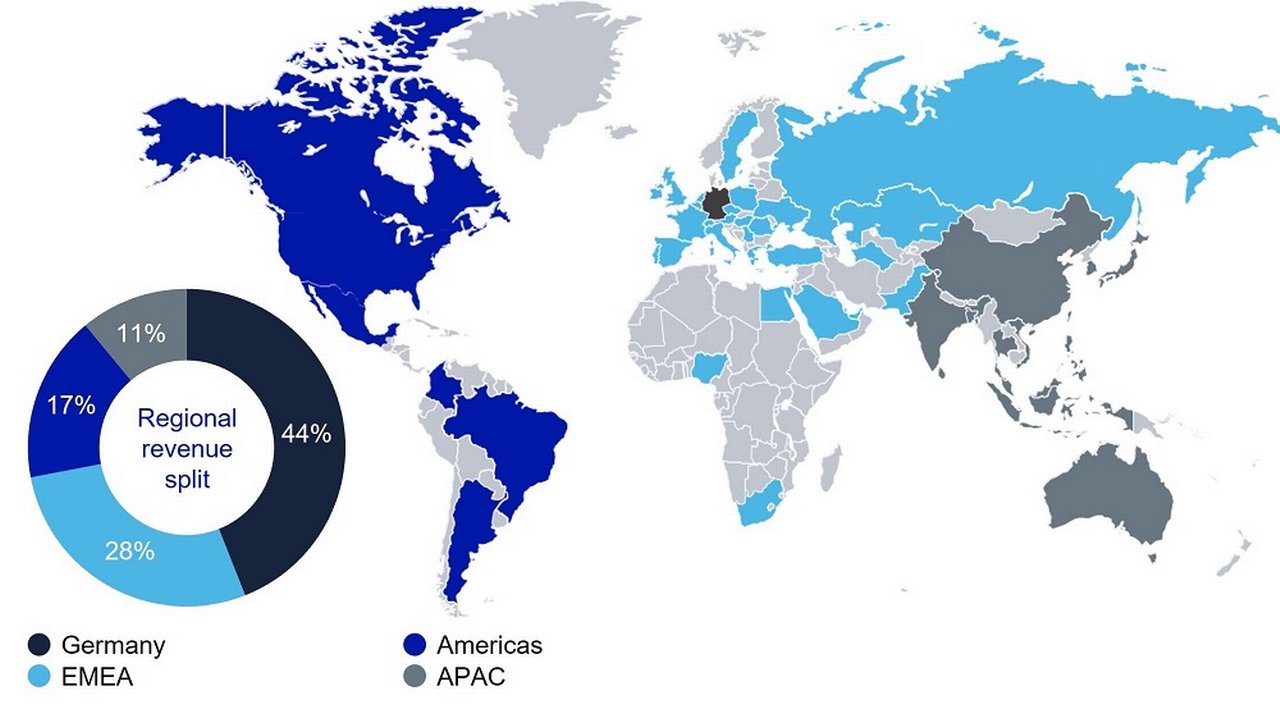

Deutsche Bank was founded in 1870 to accompany German companies abroad. Today, it is the leading bank in Germany with a strong position in Europe, represented in 56 countries around the world and globally networked.

€ 30.1bn

Revenues

€ 485bn

Loan book

€ 1.0tn

Assets under Management

(Asset Management)

€ 633bn

Assets under Management

(Private Bank)

All figures as of December 31, 2024

Purpose

Deutsche Bank has been serving clients for over 150 years. They are at the centre of everything we do – then and now.

Strategy: delivering sustainable growth

Deutsche Bank has transformed its business model since 2019, creating a leaner and more focused set-up with four client-centric businesses. It is resilient and sustainably profitable. This is the basis for entering the next phase of sustainable growth.

Expanding Deutsche Bank’s position as the Global Hausbank is at the heart of its growth strategy as it strives to become the European champion. As the leading bank in Germany with strong European roots and a global network offering a comprehensive product suite, Deutsche Bank aims to become the bank of choice for clients in all financial matters.

This means helping clients navigate geopolitical and macroeconomic shifts and accelerating their transition to a more sustainable and digitized economy. This client-centricity is the basis for Deutsche Bank to achieve sustainable growth and returns, which enable attractive distributions to shareholders.

Business model: four client-centric businesses

The Global Hausbank strategy is based on four client-centric businesses, that are market-leading. Four strong pillars, that complement each other and deliver balanced results: Corporate Bank, Investment Bank, Private Bank and Asset Management. Each of the four core businesses is well positioned to respond to structural trends that will shape the economy, delivering the total expertise of the whole bank to clients.

- The Corporate Bank is the financing and transaction banking partner that can support corporations and medium-sized companies worldwide. In Germany, the Corporate Bank also supports small businesses and self-employed business owners with payment and credit solutions as well as other banking services across three brands Deutsche Bank, Postbank and the digital bank FYRST.

- The Investment Bank has a comprehensive global offering, providing institutional and corporate clients with fixed income and currencies risk management and liquidity provision, leading financing capabilities, and a full suite of origination and advisory services.

- The Private Bank is the strongest partner for all questions on financing and investment for private clients in Germany and provides affluent clients and family entrepreneurs all over the world with tailor-made investment solutions.

- The Asset Management business offers a wide range of active, passive and alternative products that allow investors to position themselves for any market scenario.

Culture: empowered to excel together every day

With its businesses, Deutsche Bank is well positioned to serve its clients. In the end, it is about our employees – they make the difference. That is why Deutsche Bank strives for a corporate culture in which our employees are empowered to excel together every day.

An aspirational culture based on four guiding principles:

- Act responsibly to inspire trust

- Think commercially for sustainable outcomes

- Take initiative to create solutions

- Work collaboratively for the greatest impact

Financial targets: how Deutsche Bank measures success

Deutsche Bank has built a strong foundation with four core businesses focused on supporting clients. Building on this, the bank set itself following financial targets:

- Deutsche Bank aims to increase revenues on average by between 5.5 and 6.5 percent annually for the years 2021 to 2025 by fostering growth in its core franchises and by investing into targeted, strategic initiatives that produce attractive and sustainable returns.

- At the same time, Deutsche Bank will maintain strict cost discipline and further increase efficiency, aiming for a cost/-income ratio below 65 percent by the end of 2025. Deutsche Bank expects to drive efficiencies until 2025 by further reducing complexity in order to reinvest in business growth.

- As a result, the bank aims to increase its post-tax return on average shareholders’ tangible equity (RoTE) to above 10 percent by 2025 and organically generate significant additional tangible equity.

Subject to successful implementation, this would enable significant capital distribution to shareholders and substantial re-investment into Deutsche Bank’s four businesses.

As the Global Hausbank we want to be the European champion and first choice for our clients. We are convinced that Europe urgently needs a strong domestic bank with global focus.