Our path to becoming the European champion

Global Hausbank

What is the Global Hausbank?

As a Global Hausbank, Deutsche Bank aims to:

- be the home for all its clients’ financial needs, wherever in the world they are and whatever their ambitions;

- offer its clients the right combination of products and solutions to meet their needs;

- leverage its global network and local expertise in 56 markets, enabling clients to navigate a changing world and seize opportunities;

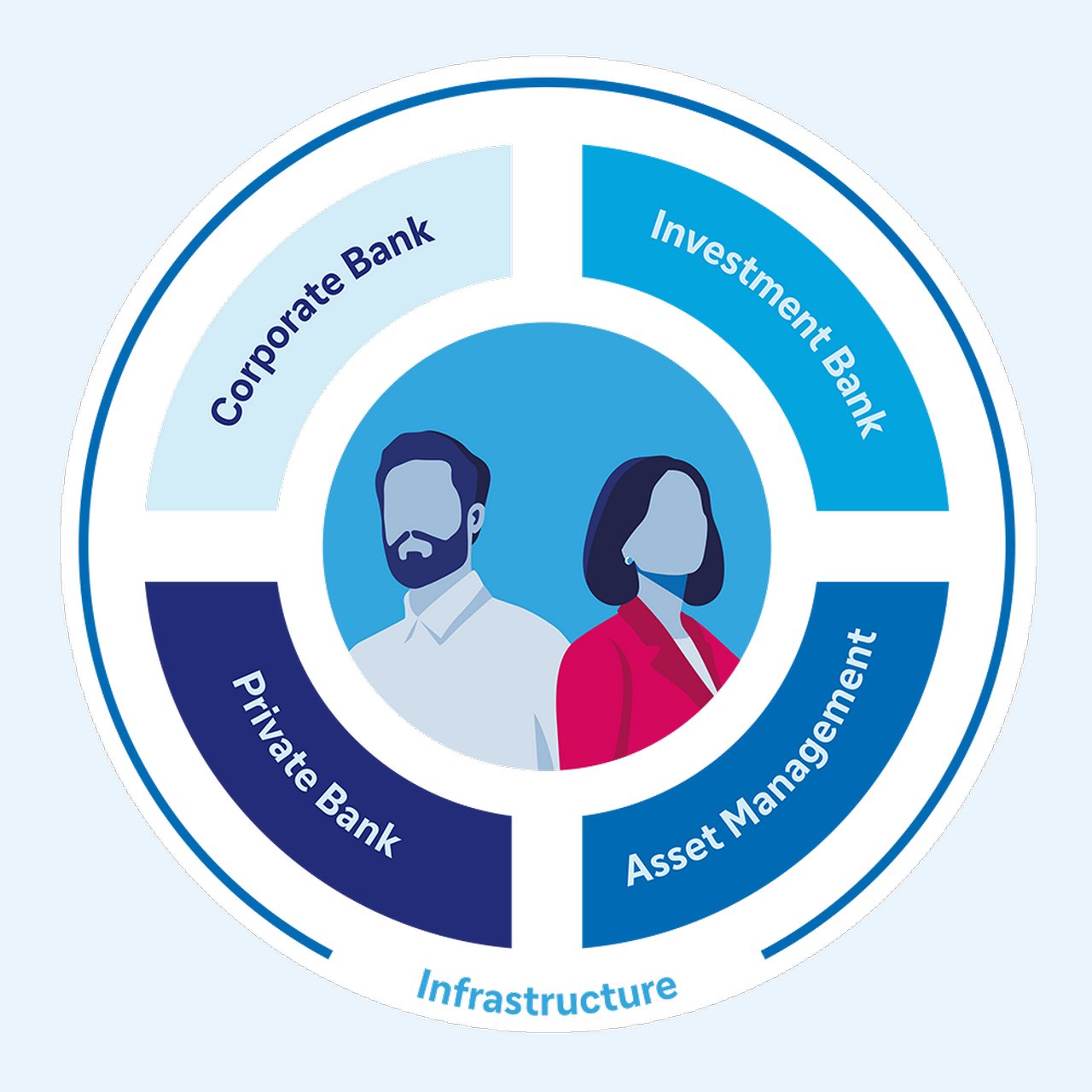

- connect across all four of its business divisions – the Corporate Bank, Investment Bank, Private Bank and Asset Management – to consistently deliver the expertise of the entire bank to its clients.

What is Deutsche Bank’s purpose?

Deutsche Bank is dedicated to its clients’ lasting success and financial security at home and abroad.

What is the bank’s strategy?

Building on its successful transformation that restored profitability and strengthened its foundations, Deutsche Bank is entering a phase of focused growth to serve clients even better. With a strong financial position and market presence, the bank will invest in its key capabilities to accelerate value creation and scale the Global Hausbank model.

How is the bank accelerating value creation?

Deutsche Bank is focusing on three levers:

Show content of Focused growth

Deutsche Bank is prioritising growth in its most value accretive areas. The focus is on its clients’ needs and those markets and businesses where the bank is already or can be a leader.

Show content of Strict capital discipline

Deutsche Bank is committed to unlocking value for clients and shareholders through disciplined capital management. This approach elevates balance sheet management to the next level and eliminates inefficiencies and creates room for both, investments in its key businesses and increased distributions to shareholders.

Show content of Scalable operating model

Deutsche Bank has identified significant upside potential by expanding and optimising its business model. By further integrating and automating processes, scaling its platforms and deploying Artificial Intelligence (AI) at scale, the bank plans to unlock further efficiencies, further enhance client experience and thereby support business growth. It invests in the development of its people to make the bank an attractive place to work for world-class talent.

What are the bank’s business divisions?

Deutsche Bank’s Global Hausbank strategy is built on four market-leading, client-centric businesses. These are:

- Supports corporations, medium-sized companies, and financial institutions worldwide with financing and transaction-banking solutions.

- In Germany, it also serves small businesses and the self-employed with payments, credit solutions, and other banking services across Deutsche Bank, Postbank and the digital bank FYRST.

- Serves as the trusted partner for private clients in Germany on all financing and investment needs, delivering seamless omnichannel experiences that combine personalised advice with innovative digital solutions.

- Provides European affluent clients with tailor-made investment solutions and is the primary banking partner for global ultra/high-net-worth individuals (UHNWI & HNWI) and family entrepreneurs.

- Provides institutional and corporate clients with solutions across fixed income and currencies, expertise in risk management and liquidity provision as well as leading financing capabilities.

- Supports clients with investment banking and capital market products and services. Those include arranging IPOs, bonds and syndicated loans as well as advising on mergers and acquisitions (M&A).

- Offers a broad range of active, passive, and alternative investment DWS products for private and institutional clients to help them navigate any market scenario.

- Enables clients to follow current trends in markets, developing innovative solutions, for example in the field of digital assets.

Each of the four core businesses is well positioned to respond to structural trends that will shape the economy, delivering the total expertise of the whole bank to clients.

What are the bank’s targets, capital objectives and ambitions?

>5%

Revenues: Compound Annual Growth Rate (CAGR)

2025-2028

<60%

Cost-to-Income Ratio (CIR)

in 2028

>13%

Return on Tangible Equity (RoTE)

in 2028

13.5-14.0%

CET1 Capital Ratio

The bank’s long-term vision: to become the European Champion

✓ European leadership across key segments

✓ Market-leading returns

✓ Deep and scaled global presence and network

✓ AI-powered and innovation-focused bank

Deutsche Bank in a nutshell

Who is Deutsche Bank?

As a Global Hausbank with four strong businesses and a global network, Deutsche Bank is the first-call partner for its clients in all financial matters, at home and abroad.

What does Deutsche Bank do?

Deutsche Bank provides its clients with the right combination of products and solutions to meet their financial needs.

What does Deutsche Bank want to achieve?

Deutsche Bank’s goal is to unlock significant further growth potential, building on its position as the trusted partner for clients in a changing environment.

Glossary