Purpose

What Deutsche Bank stands for

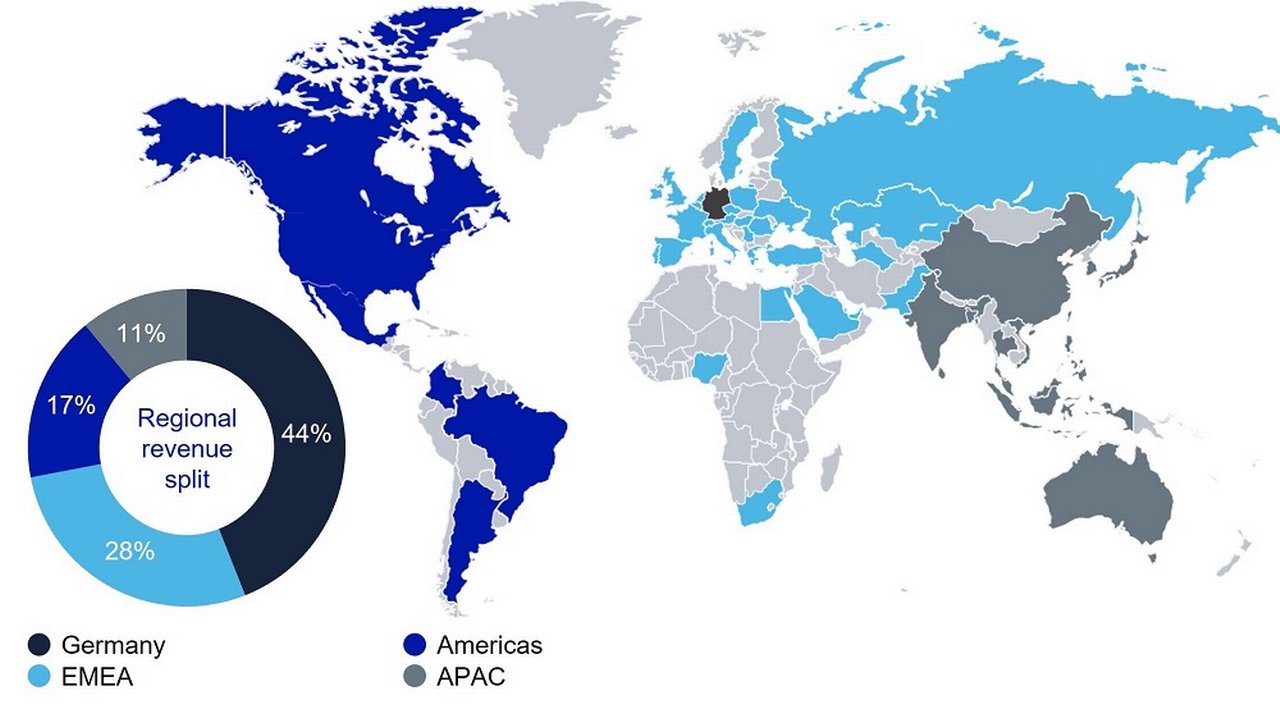

Deutsche Bank was founded in 1870 to accompany German companies abroad. Today, it is the leading bank in Germany with a strong position in Europe, represented in 56 countries around the world and globally networked.

Deutsche Bank has been serving clients for over 150 years. They are at the centre of everything we do – then and now.

Deutsche Bank’s global footprint

Global network Global network

Deutsche Bank has established strong bases in all major emerging markets, and therefore has good prospects for business growth in fast-growing economies, including the Asia Pacific region, Central and Eastern Europe, and Latin America.

In Europe, Deutsche Bank is well placed to benefit from the aforementioned resilient conditions in its home market, Germany, and from continued strong levels of corporate activity in the euro zone.

89,753

Employees

160

Nationalities

56

Countries

€ 30.1bn

Revenues

€ 485bn

Loan book

€ 1.0tn

Assets under Management

(Asset Management)

€ 633bn

Assets under Management

(Private Bank)

All figures as of December 31, 2024

Products and services

Four client-centric businesses

- The Corporate Bank is the financing and transaction banking partner that can support corporations and medium-sized companies worldwide. In Germany, the Corporate Bank also supports small businesses and self-employed business owners with payment and credit solutions as well as other banking services across three brands Deutsche Bank, Postbank and the digital bank FYRST.

- The Investment Bank has a comprehensive global offering, providing institutional and corporate clients with fixed income and currencies risk management and liquidity provision, leading financing capabilities, and a full suite of origination and advisory services.

- The Private Bank is the strongest partner for all questions on financing and investment for private clients in Germany and provides affluent clients and family entrepreneurs all over the world with tailor-made investment solutions.

- The Asset Management business offers a wide range of active, passive and alternative products that allow investors to position themselves for any market scenario.

Sustainability Sustainability

Deutsche Bank aspires to contribute to an environmentally sound, socially inclusive, and well-governed world. With its financial expertise and product offerings, the bank wants to enable the path to a more sustainable and climate-friendly way of conducting business.

Dedicated to the society of today and generations of tomorrow

We’re not just a part of communities — we play an active role in helping to shape them. Wherever we are in the world, we create a culture of giving — to enrich the lives of those around us. Whether it’s education initiatives, looking after our planet, delivering basic needs, or providing relief in emergencies, we are passionate about making a difference. We work together with like-minded partners towards these goals. Our people are at the heart of this — proud to offer their skills and expertise. Together, we are deeply dedicated to empowering change — for the society of today and generations of tomorrow.

Boards and committees

The Deutsche Bank boards and committees consist of the Management Board, the Supervisory Board and the Committees of the Supervisory Board.

Strategy Strategy

Expanding Deutsche Bank’s position as the Global Hausbank is at the heart of its growth strategy. As the leading bank in Germany with strong European roots and a global network offering a comprehensive product suite, Deutsche Bank aims to become the bank of choice for clients in all financial matters.

Financial products and services Business

Deutsche Bank provides financial services to companies, governments, institutional investors, small and medium-sized businesses and private individuals.

History Roots

Deutsche Bank was founded in 1870 to accompany German businesses into the world, and has worked across borders ever since.