Risk and vision: investments in tech pioneers

Throughout its history, Deutsche Bank has supported visionary technical projects – from the transatlantic cable and electric high-speed trains to rocket experiments and solar aircraft. Often ahead of their time, sometimes risky, but always groundbreaking.

The Victorian internet

Telegraphy has been key to Deutsche Bank's global business since its founding in 1870. It enabled the bank to manage its branches and subsidiaries in London, Asia, Latin America, and the US from Berlin and transmit messages in the shortest possible time.

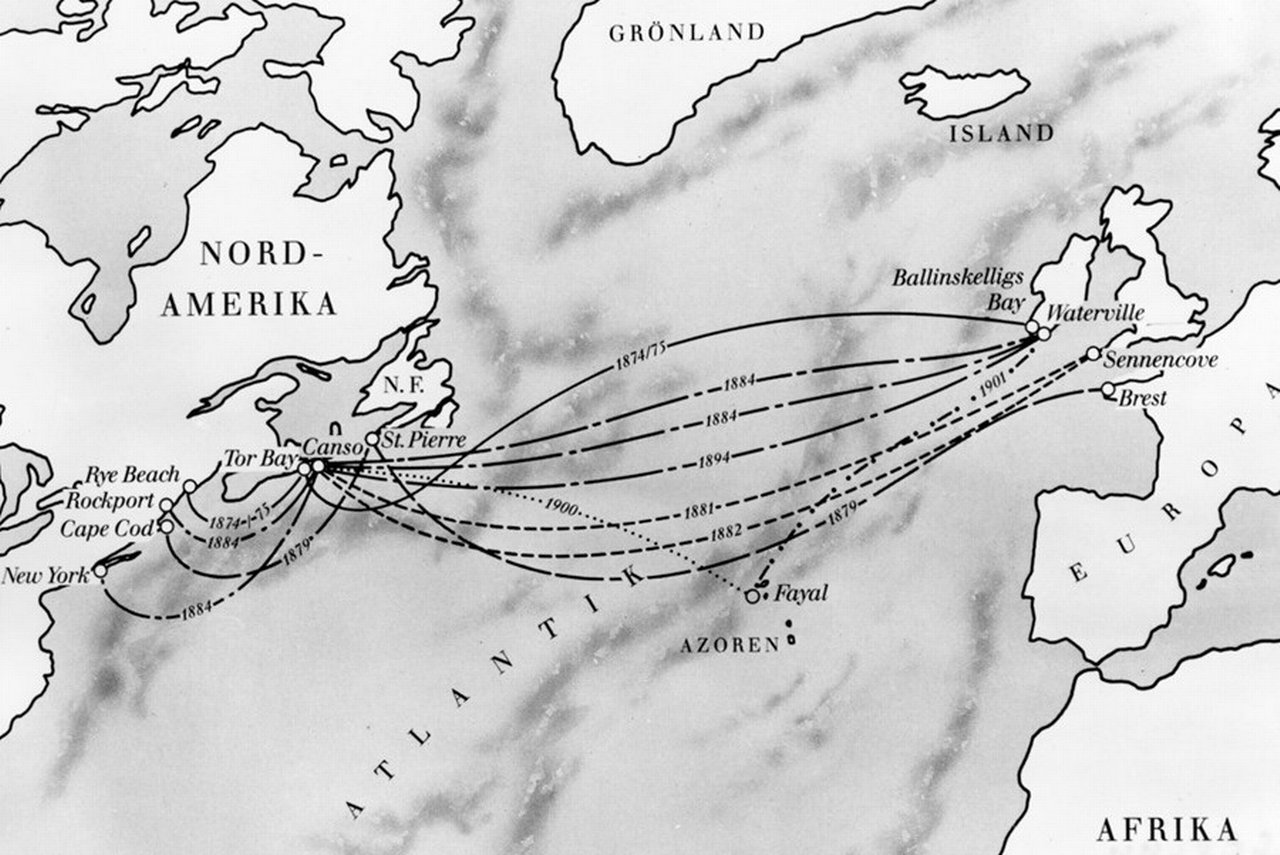

As a catalyst for global trade, telegraphy via land and sea cables was indispensable. A connection between Europe and North America was particularly in demand, but the technical hurdles were enormous. After an initial, short-lived attempt in 1858, a more successful transatlantic cable was laid in 1866.

This inspired imitations. In 1873, the Siemens family of entrepreneurs and inventors founded the "Direct United States Cable Company" with the goal of laying another telegraph line between Great Britain and the US. Using the company's own cable-laying ship Faraday and a newly developed cable, the connection was completed as early as 1874.

Georg Siemens, the first Spokesman of the Management Board of Deutsche Bank and a relative of the Siemens family, believed in the project. However, since his fellow Management Board members and the Administrative Board hesitated, the bank participated only to a limited extent. When a share placement did not attract sufficient demand, Georg Siemens rescued the venture by privately purchasing shares.

Despite its technical success, the company lost out to strong British competition. It was dissolved with a significant loss for the investors, including Georg Siemens.

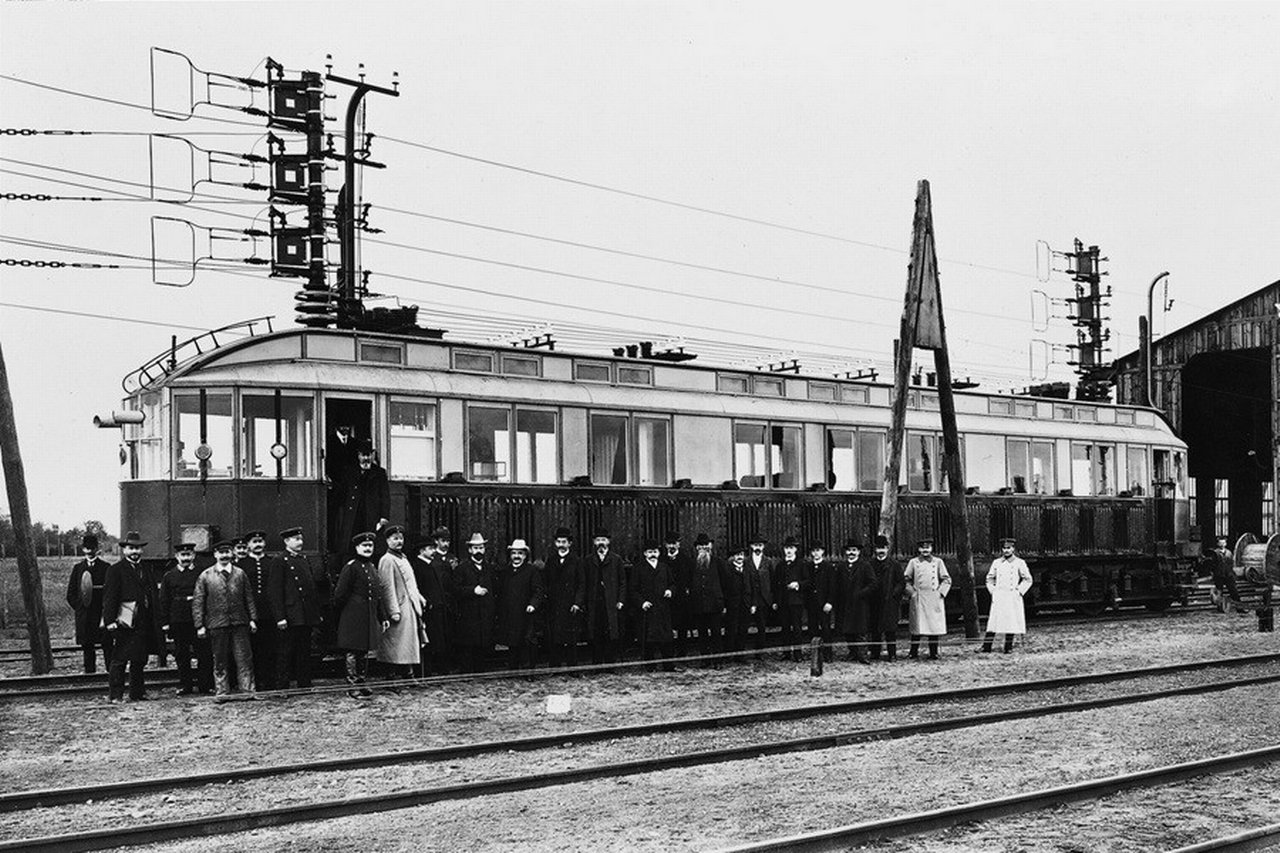

Electric high-speed railways

At the end of the 19th century, experiments with electric high-speed trains began. To evaluate whether power supply via an overhead line would work even at high speeds, the Studiengesellschaft für elektrische Schnellbahnen (Study Group for Electric High-Speed Railways) was founded in 1899. Deutsche Bank led the consortium with a 20 percent stake.

Other shareholders included leading industrial companies such as AEG, Siemens & Halske, Krupp, and banks such as Delbrück, Leo & Co. and the Nationalbank für Deutschland. For the test runs, a 23-kilometer track was set up in the south of Berlin. The Cologne-based company van der Zypen & Charlier built two railcars, whose electrical equipment came from AEG and Siemens & Halske.

During the test runs in 1903, a top speed of 210 km/h was reached. Arthur Gwinner, a Management Board member of Deutsche Bank, rode a train at 180 km/h – holding the speed record for Deutsche Bank Management Board members for many years.

Although the experiments were a technical success, they proved to be too far ahead of their time. An economic profit was not immediately realisable. After the study group had fulfilled its purpose, it was dissolved in 1905.

On the way to the moon

Engines in the air and on the ground fuelled the imagination of Deutsche Bank's Management Board in the 1920s and 1930s, as seen in the bank's involvement with companies such as Daimler-Benz, BMW, and Lufthansa. Deutsche Bank also had early contact with the most modern engine technology of the time, rocket propulsion.

In 1931, Wernher von Braun, then only 19 years old, sought financial support from the bank for his research and experiments in rocket technology. The later famous space pioneer designed the Saturn V launch vehicle for the first moon landing but also the notorious "V2 vengeance weapon". Fascinated by explosives and fireworks as a teenager, von Braun experimented with rockets and various other flying objects.

From the perspective of the financiers, the new technology was not yet market-ready. During the demonstration at the rocket launch site, the bank's representatives only saw failed attempts. Their interest in rocket technology ended early. Nevertheless, von Braun had a successful career taking him to the top of NASA's "Marshall Space Flight Center" in 1960.

Solar Impulse

Aiming to advance and promote renewable energies, the Swiss Bertrand Piccard and André Borschberg developed a solar aircraft. The "Solar Impulse" aircraft project was intended as a symbol to convey the message that with today's technologies, dependence on fossil fuels can be reduced.

They are well qualified. Borschberg is a trained pilot, and Piccard comes from a pioneering family: his grandfather set an altitude record in a balloon in 1932; his father reached the deepest point of the sea in 1960; and Piccard himself was the first to circumnavigate the Earth non-stop in a balloon in 1999.

With their enthusiasm, Borschberg and Piccard won Deutsche Bank as one of their main sponsors. The bank supported Solar Impulse because the project vividly demonstrated the potential of renewable energies.

Before the maiden flight on April 7, 2010, major technical challenges had to be overcome. The aircraft required an extreme lightweight construction and batteries with maximum storage capacity. These were powered by over 11,000 silicon cells on the wings, whose 63.4-meter wingspan corresponded to that of an Airbus A340.

A milestone was the first 24-hour flight in July 2010, which proved that the aircraft could also fly at night. During the day, it charged its batteries at an altitude of over 9,000 meters to survive the night. Further successes followed: in 2012, the first intercontinental flight of a solar aircraft, and in 2013, the crossing of the US in five stages.

In 2016, the team completed the planned circumnavigation of the world by landing in Abu Dhabi.

From telegraphy to solar aircraft – for over 150 years, Deutsche Bank has consistently supported visionary technologies. Some projects were ahead of their time, others set new standards. What they all have in common is the drive and courage to promote innovations and make them economically viable in the long term.

This page was published in February 2026.

Martin L. Müller

… as Deutsche Bank’s corporate historian, has been studying the with the various facets of industrial financing for many years. Recognizing technical innovations early on – whether on land, at sea or in the air – often played a decisive role in Deutsche Bank's over 150-year history.

Recommended content

Digital Disruption | Quiz

Space Quiz: Test your knowledge about the future of space travel Space Quiz: Test your knowledge about the future of space travel

Think you’ve got the future of the space economy figured out? Don't be fooled by every overly futuristic‑sounding answer that comes along.

Digital Disruption | Insights

Private space race accelerates: Innovation opens the final frontier Private space race accelerates: Innovation opens the final frontier

Space was once the dream of nations, now it’s the ambition of innovators. Watch 99 seconds with space economist Edison Yu.

Private space race accelerates: Innovation opens the final frontier Uncover race to spaceDigital Disruption | Crisp & Short

Growth greetings from Mars: the 6 hottest trends in the space economy The 6 hottest trends in the space economy

Space is fast becoming an indispensable economic consideration. Here six developments you should be prepared for – from 3D printing to laser communication.

Growth greetings from Mars: the 6 hottest trends in the space economy Growth greetings from Mars