Sustainable home financing over the decades

Deutsche Bank has been providing residential mortgages since 1968. During the 1970s oil crisis, it began advising clients on energy saving concepts like solar panels and heat pumps. Read on to find out how else Deutsche Bank has been championing sustainable homes over the years.

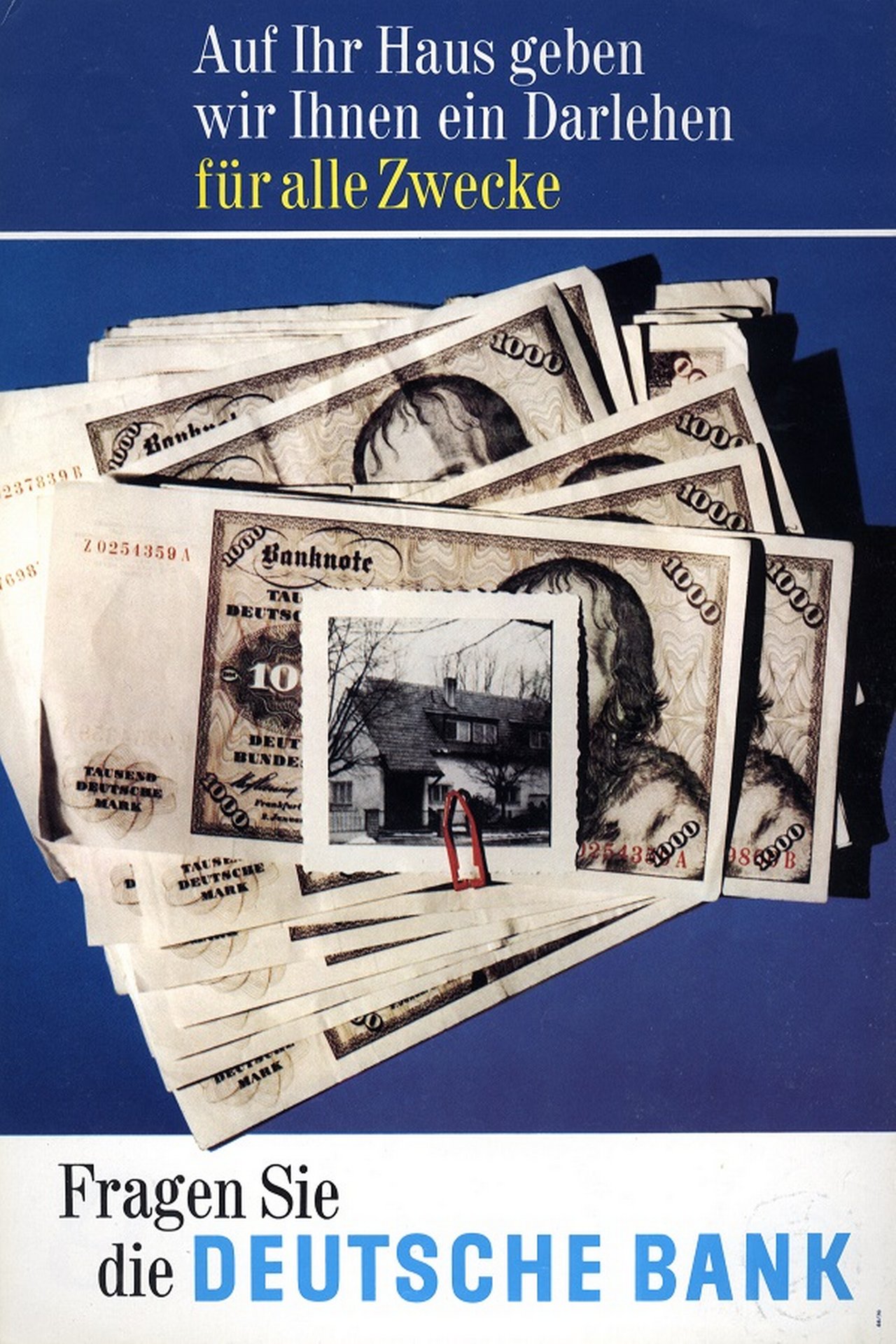

New products during the German economic miracle

For most people, building or buying a property is the largest and most long-term expense of their lives. Often, three decades pass from taking out a mortgage to the final repayment. Therefore, it is crucial that homes are affordable and sustainable when built.

During the German economic miracle, Deutsche Bank started offering clients a greater range of products, which included mortgages. Before 1968, affiliated mortgage banks were where clients went to finance their home.

When Deutsche Bank first started offering this kind of loan to clients directly, they were initially called “personal mortgage loans” with the emphasis being on people taking out a mortgage on a home they already owned. From 1972, the focus shifted and the bank renamed them “personal building loans” for a house they wanted to build or buy. The loan amount was anything between 50,000 and 300,000 Deutsche Marks and had a term of almost 30 years.

A modular system for home financing

Under the impact of the oil crisis, energy saving played an even greater role in real estate. In a brochure published in 1979 entitled “Financing older homes”, the bank’s aim was to inform clients about building renovations and modernization as well as energy saving.

The state supported energy-saving measures with direct subsidies and tax advantages. The bank's advice from almost 50 years ago is still just as relevant today, with phrases like “improved thermal insulation”, “reduced energy consumption for central heating and hot water systems” and “energy from heat pumps and solar panels”.

Forward-looking concepts from as early as the beginning of the 1980s

In the brochure “Planning, Building and Energy”, Deutsche Bank advised its clients in the early 1980s on topics such as protecting against heat loss, heating and hot water systems. Forward-looking concepts such as solar power, heat pumps and heat recovery systems were already playing an important role.

This page was published in November 2025.

Martin L. Müller

… as Deutsche Bank’s corporate historian, has been studying the various aspects of financing construction projects for many years. These range from financing residential buildings through mortgages and loans from building societies to major infrastructure projects such as railways and power plants, as well as the premises used by Deutsche Bank itself.

Recommended content

Responsible Growth | Expert View

How does sustainable building work? Sustainable building: It’s all about the right order

Housing crisis and climate change: The building sector drives CO₂ – refurbishment is key to making sustainable building a reality. Alf Meyer zur Heyde knows how.

How does sustainable building work? How does sustainable building work?Responsible Growth I Insights

Climate protection starts at home Climate protection starts at home

From Frankfurt to Bangalore, Deutsche Bank colleagues show how sustainable living starts at home – with solar panels, green power and creativity.

Climate protection starts at home Meet our climate heroesResponsible Growth | Crisp & Short

The pinnacle of green construction: the best from nature and lab The pinnacle of green construction: the best from nature and from the lab

In tomorrow's world, buildings could be made from things that are alive, intelligent and just different. New materials are changing how we think and live.

The pinnacle of green construction: the best from nature and lab Green and genius